Getting Started

- Introduction

- Download

- Installation & Activation

- Troubleshooting

- Data Refresh/Updates

- Software Updates

- Manage Your Subscription

- Example Spreadsheets

General Formulas

Technical Analysis Toolkit

- Introduction

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

- Volume Weighted Average Price (VWAP)

- Average True Range (ATR)

- Moving Average Convergence/Divergence (MACD)

- Bollinger Bands

- Relative Strength Index (RSI)

- Aroon

Federal Reserve Economic Data

(FRED)

Yahoo Finance

IG Index / IG Markets

- Account Setup

- Formula Reference

- VBA Functions Reference

- Historical Price Data Download To Excel

- Historical Price Data Download To File

- Historical Client Sentiment Data Download

- Watchlists

- Live Positions, Transactions & Activity History

EODHistoricalData.com

Nasdaq Data Link

Technical Indicators: Average True Range

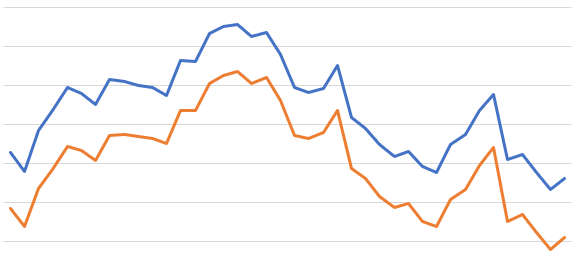

The Average True Range (ATR) indicator is a volatility indicator that gives you a sense of how much the price could be expected to move.

This indicator can help with deciding when to enter a trade and also where to place a stop-loss order. It moves up and down as price moves become larger or smaller, and if you combine it with an Excel chart you can see how volatility changes over time.

The Excel formula for calculating the Average True Range is:

=EPF.TA.ATR(closePrices, highPrices, lowPrices, datesTimes, lookbackPeriods)

The input parameters required are:

| Parameter | Description |

|---|---|

| Close Prices | An Excel range of the close prices. |

| High Prices | An Excel range of the high prices. |

| Low Prices | An Excel range of the low prices. |

| Lookback Periods | The number of periods in the lookback window. |

The range of prices and dates must correspond and be of the same length, for example the first date in the date range must correspond to the first price in the price range.

The output columns are:

| Output Column | Description |

|---|---|

| ATR | The average true range. |

| Date | The date that the average true range corresponds to. |